What the “One Big Beautiful Bill” Means for Americans and Their Charitable Donations

We at The Water Project know our donors and blog readers want to do as much good as they can. To help you do that and keep you informed, we decided to share some information about upcoming tax changes that may affect your decisions about charitable gifts.

The rules for taxes and charitable giving in the United States are changing. A new law, nicknamed the One Big Beautiful Bill (OBBB), will take the place of the 2017 Tax Cuts and Jobs Act (TCJA).

If you regularly donate to causes you care about — like bringing water to people in sub-Saharan Africa — you may wonder what this change means for you. We’ve worked to translate all of the new information to keep you informed and help you make decisions both for the 2025 and 2026 tax years.

Please note: We are not tax advisors, and this information is meant for general understanding and awareness, not financial advice.

How did charitable gifts work before the “Big Beautiful Bill”?

When the TCJA took effect in 2018, the legislature “nearly doubled” our standard deduction (the amount of money most people can subtract from their income before being taxed). This increased standard deduction made filing taxes simpler, but it also meant fewer people could itemize their deductions, like mortgage interest — or charitable gifts.

For most people, the TCJA made the standard deduction much larger than the total of their itemized deductions. Since everyone wants to pay tax on the lowest amount possible, people naturally chose the bigger standard deduction.

This meant that, for many years, only people who gave large amounts or deducted other big expenses could see a tax benefit from their charitable giving.

How will taxing charitable donations work now?

For seniors aged 65 and older, parts of the One Big Beautiful Bill begin in the 2025 tax year, and for everyone else, most changes will take effect in 2026.

If you’re 65 or older, the bill adds a new “senior deduction” for the next few years, which allows you to deduct up to $6,000 per person or $12,000 per couple on top of your regular standard deduction. This gives retirees on fixed incomes a little more breathing room; however, higher-income seniors will see this deduction phase out as income rises.

When the OBBB begins for other donors next year, charitable giving will change for everyone.

Even if you don’t itemize your deductible expenses, everyone who files a tax return in 2026 will be able to subtract up to $1,000 (if you file alone) or $2,000 (if you file jointly) in cash gifts to charities from their taxable income each year. This means almost anyone who donates to a charity will experience some tax benefit.

2026 will also introduce a small “floor” for those who choose to itemize. So, if you do itemize your deductions, your giving will only count after it adds up to 0.5% of your income (specifically, your Adjusted Gross Income, or AGI). For example, if you earn $100,000 in 2026, the first $500 you give (.5% of your $100,000 in earnings) won’t count for a deduction, but anything above that will.

For people with higher incomes, the new bill is less generous. Even though itemizers can still deduct large cash gifts — up to 60% of their income — the tax savings will be slightly smaller. If you’re in the highest tax bracket, you’ll now save about 35 cents in taxes for every dollar you donate, instead of about 37 cents under the current rules.

How else might the OBBB affect my charitable giving choices moving forward?

This massive bill could affect how much of your income is taxed in some other ways, which might influence how much you (or your company) feel able to give.

Deduction for tips and overtime pay (2025–2028):

If you work in a job where you earn tips or extra pay for overtime, you may be able to deduct some of that income before it’s taxed.

Car-loan interest deduction:

For a few years, people who buy new, U.S.-assembled vehicles may be able to deduct the interest they pay on their car loans (up to certain limits).

Changes to the state and local tax (SALT) deduction:

The OBBB raises the cap on the amount of state and local taxes you can deduct in 2025. If you live in a high-tax state, this could change whether you choose to itemize or take the standard deduction, and that choice directly affects whether your charitable gifts count for tax purposes (until the new charitable deductions impacts occur in 2026).

Corporate giving floor:

For businesses, the new law adds a minimum giving threshold. Starting in 2026, only the portion of a company’s charitable donations that exceeds 1% of its annual income can be deducted from taxes. For example, if a company earns $1 million in a year, its first $10,000 (1%) in charitable gifts won’t be deductible, but anything beyond that amount will be.

If your company offers a gift-matching program, this rule could influence when or how those matches are made.

What does all this mean for me?

No matter your income, there are simple ways to make the most of your charitable giving now, during the upcoming holiday season, and after most of the OBBB changes take effect in 2026.

For Everyone

Starting in 2026, nearly everyone can deduct a little something from their taxable income. You will be able to deduct up to $1,000 (for individuals) or $2,000 (for couples) in cash donations even if you take the standard deduction. This change invites more people — and nonprofit organizations — to benefit from charitable gifts in 2026.

For Donors Who Itemize

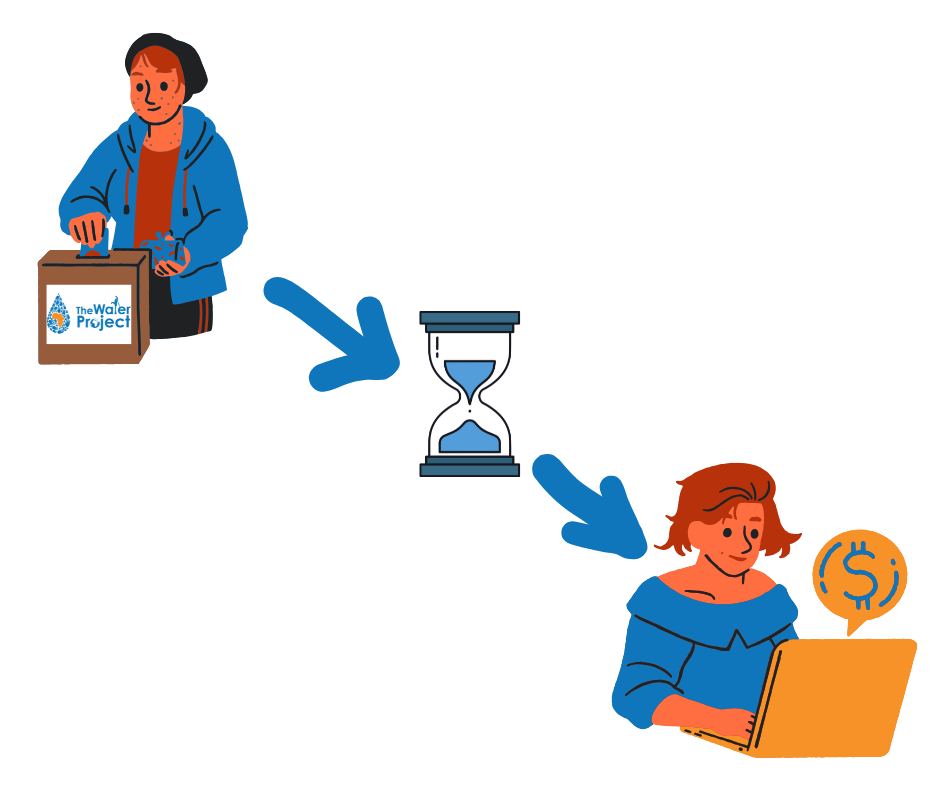

If you plan to make a large gift, 2025 may be the best year to do it before the new 0.5% floor and benefit cap take effect.

You might consider “bunching,” which means combining two years of giving into one to get over the 0.5% deduction threshold that starts in 2026.

Or give appreciated assets. Donating stocks or mutual funds that have grown in value can avoid capital gains tax and still count as a deductible gift.

For Retirees

If you’re 65 or older, don’t forget about the new senior deduction that begins this year. It lowers your taxable income before any charitable giving is even counted.

If you have a Traditional Individual Retirement Account (IRA), Qualified Charitable Distributions (QCDs) let you donate directly from your Traditional IRA so the amount isn’t counted as taxable income — and because the OBBB introduces new rules (floors, caps, senior deduction), this strategy is now even more powerful. QCDs reduce your taxable income before it even shows up on your return, so they’re not affected by the new floors or deduction caps that apply to regular charitable gifts.

If you were thinking of making a large charitable gift in the next year or two, you might consider giving part of it via QCD from your IRA before the end of 2025, as the new rules in 2026 will make itemized giving a bit tougher.

For Higher-Income Donors

The new bill lowers the top tax savings rate for charitable gifts in 2026, from 37¢ to about 35¢ per dollar. Consider making a larger gift before the end of 2025 to benefit from the current higher deduction rate.

Our Final Word

At The Water Project, we know you give because you care, not just for the tax benefits. But when the rules change, we want our donors to stay informed so they can keep making the greatest impact possible.

Tax codes change, but the benefits of gaining access to clean water are still incredible for individuals, families, communities, counties, and countries in Africa. If you’re thinking about making a difference before these new rules take effect, your gift today can change people’s lives for years to come.

Home More Like ThisTweet